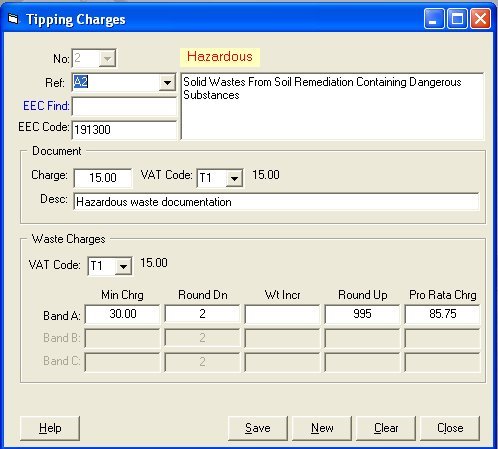

Tipping Charges |

Setup different rates of charges for tipping waste. |

No. To ament any previously defined tipping charges, select them from this dropdown list.

Charge. Enter any charges for accompanying documentation. VAT Code. If VAT is applicable to the documentation charge then select the appropriate VAT code from the drop-down list. Desc. Enter a short description for the type of documentation.

VAT Code. Select the appropriate VAT code for the waste being tipped. Min Chrg. Enter the minimum tipping charge that is to applied. If there is no minimum charge then enter zero. Round Dn.If the weight is above a whole unit (tonne) by a set number of Kg, you may wish the weight to br rounded down to the nearest tonne. For example you may want 1.09 Tonnes to be rounded down to 1 tonne. To achieve this you would enter a value of 9 (Kg) or higher. Wt Incr. You can choose to charge for tipped waste for say every 10, 50 or 100Kg. If this is the case, simply enter the incremental Kg figure you wish the weight to be calculated against. However, if you wish to charge for tipped waste strictly on a per tonne basis then enter a figure of zero. Round Up. If the weight is just under a whole tonne (e.g. 1.920) and you want it to be rounded up then enter the point at which it should be rounded up. For example to round up 1.920Kg to 2.0 tonnes, you would enter a figure of 920 Kg or less. Pro Rata Chrg. This is the tipping charge for the selected waste type on a per tonne basis.

|